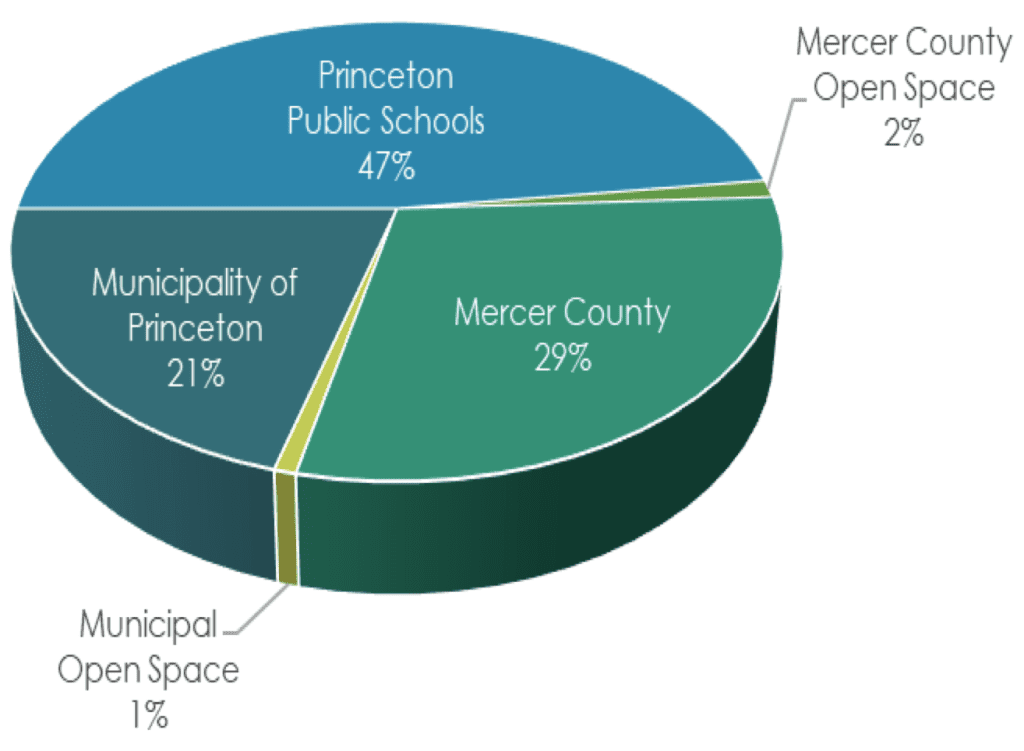

By now, your tax bill has arrived in the mail (and you have until August 23rd to make your payment without penalty). The Budget newsletter accompanying your bill does a good job of breaking down some key elements, which compile the full bill of taxes owed for the municipality, the public schools and the county.

As you can see, both Princeton Public Schools and Mercer County comprise the largest portions of your bill – at 47% and 29% respectively. But it is the municipal portion, at 21%, that handles things most residents need or encounter daily. So today, that is the portion we are going to delve into, to offer you some greater explanations about where your money is going and why it is needed.

WHO IS PAYING WHAT

To understand how municipal tax bills are formulated, it is important to first understand who is paying taxes. Princeton is home to numerous schools, charitable organizations, cemeteries and there is a lot of property in the area owned by the town or state. Those, in addition to disabled veterans, senior and affordable housing and other exempt entities, bring a lot of important value to Princeton – but they do not bring in tax money. While there are some payments in lieu of taxes given to the municipal coffers, the exemption of 882 entities means the tax burden is split amongst the 7,991 properties that make up the tax base.

To understand how municipal tax bills are formulated, it is important to first understand who is paying taxes. Princeton is home to numerous schools, charitable organizations, cemeteries and there is a lot of property in the area owned by the town or state. Those, in addition to disabled veterans, senior and affordable housing and other exempt entities, bring a lot of important value to Princeton – but they do not bring in tax money. While there are some payments in lieu of taxes given to the municipal coffers, the exemption of 882 entities means the tax burden is split amongst the 7,991 properties that make up the tax base.

For each of those tax-paying properties, an assessment is determined by Princeton Tax Assessor, Neal Snyder. In January, you should have received a postcard which details the assessed value of your property. This assessment is a percent of the market value of your property, which for 2024 was 70.51%, and it determines how much of the big pot you must provide. If you feel your assessment is not correct, you have 45-days to appeal before your value is weighed into the overall budget.

“The budgets come in spring or early summer and at the end of July, the state tells us how much we’ll get. That’s when the tax rate is struck,” notes Snyder.

THAT STRIKING NUMBER

When you opened your tax bill, your first reaction was likely the displeasure of noticing it is higher than last year. That is because the 2024 municipal tax rate increased by $0.025, the amount needed to cover a budget shortfall of $1.9 million. Over the past 10 years, the average assessed home in Princeton (valued at $853,136) has seen their property taxes go from $18,641 in 2014 to $22,719 in 2024, a 22% increase.

“The governing body could try to artificially keep taxes at the same rate for some number of years; but that method almost always ends up with a one-time significant ‘catch-up’ increase when you stop doing that,” Mayor Mark Freda explains. “And the impact is much worse on taxpayers; so, it is generally thought that the method of trying to control the increase as much as possible each year is ‘better’ for most taxpayers since a moderate increase per year is usually easier to handle than a one-time unanticipated large increase.”

DETERMINING THE FINANCES

The 2024 municipal budget is $74,514,097, and only 54% of that comes from taxes. As the Budget Newsletter details, there is other revenue from “parking and traffic enforcement fees, sewer fees, and fire and housing inspection fees.” Additional monies come from reserves, state aid, grants and payments in lieu of taxes (including Princeton University’s contribution), as well as from some of the nonprofit and other entities mentioned above. Princeton is currently sitting on a surplus that has increased $3.5 million, so why isn’t more of that used to keep taxes lower?

The 2024 municipal budget is $74,514,097, and only 54% of that comes from taxes. As the Budget Newsletter details, there is other revenue from “parking and traffic enforcement fees, sewer fees, and fire and housing inspection fees.” Additional monies come from reserves, state aid, grants and payments in lieu of taxes (including Princeton University’s contribution), as well as from some of the nonprofit and other entities mentioned above. Princeton is currently sitting on a surplus that has increased $3.5 million, so why isn’t more of that used to keep taxes lower?

“We have to maintain a surplus,” Freda states. “The same as with someone’s home or personal budget. Unexpected circumstances, revenue that didn’t come in as expected, etc. Our surplus balance influences our financial rating, which drives what it costs us to issue bond anticipation notes and general obligation bonds for capital spending. The higher our financial rating, the lower those bonds cost us. So, the lower the tax impact of those bonds on our taxpayers.”

Still, Princeton used $11,708,000 of its surplus funds to help offset things. This came from two sources, 49% of the “current fund surplus” and 27% the “parking utility fund surplus.” In order to retain any necessary surpluses for the future, there is an expectation these funds will get replenished.

There’s also the reality that tax increases are in part due to the cost that services provided have gone up significantly, and those costs are passed onto taxpayers. Sewage treatment is one of these, but there is hope that the ongoing sewer replacement project will help to curb this down the road. Another increased expenditure is for trash collection, which is up $340,000 for 2024, despite the contract changes that were made.

As you pull out your 64-gallon can each week, you are kept keenly aware that the municipal trash collection system changed. Municipal leaders say this had to be done, or the costs would have become unaffordable. Despite best efforts, 2024 collection costs still increased 8% and waste transfer, known as tipping fees, were 17% higher than last year. Across town, nearly 7,500 trash cans are collected.

“The tipping fees are set by the Mercer County Improvement Authority on an annual basis and are based on their costs to accept, transport, and dispose of the solid waste at a landfill in Pennsylvania. The collection fees were set by contract at a fixed fee per month. The hauler determined their costs based on the number of 64-gallon trash carts to be provided and collected,” Freda explains.

WHERE DOES YOUR MONEY GO

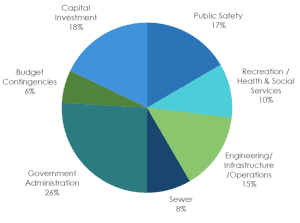

Of the $74,514,097 collected, 41% of the budget is non-discretionary – meaning it is necessary and has to be paid out. There are opportunities within the remaining 59%, such as deciding to go with less expensive vendors, but much of the budget needs remain fairly consistent from year to year. The largest amount of tax income, 26%, goes towards government administration. This includes salaries and wages for the Mayor and Council, but also covers the Municipal Clerk, Chief Financial Officer, Tax Collector and more.

Capital investments, projects like the Witherspoon Street Improvements Project, which provide long-term benefit to the community, make up 18% of the budget. The rest is split between infrastructure/operations, public safety, recreation, health & social services, sewer and other budget contingencies. If you like to take advantage of the public parks and playgrounds, have ever called animal control or are grateful for the police and fire department services, this is where their funding comes from.

OPEN SPACE

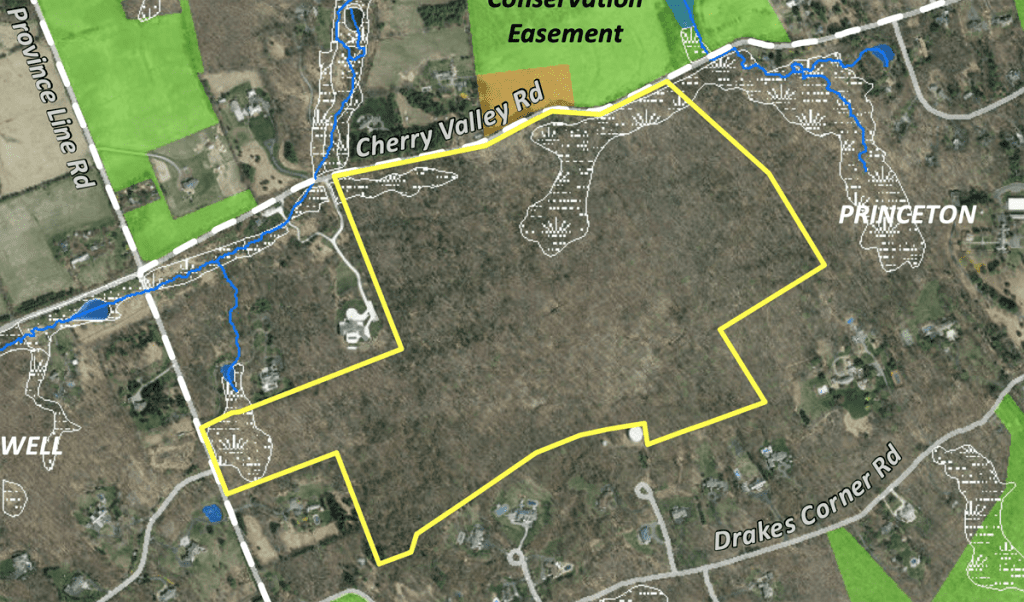

There’s also a separate line item appropriated through tax collection for both county and municipal open space. In 2021, Princeton acquired 153-acres, the largest tract of undeveloped land in town, known as the Lanwin Provinceline Woods Property. It is located along Provinceline and Cherry Valley Roads. Money from the open space fund has been used to pay interest on the bond anticipation note and will be paying off the interest and principal once it’s converted to a permanent bond.

“In past years some money from this fund helped with the footbridge project at Mountain Lakes and for parking by the trail system at the Ridge. This budget also covers the tree inventory & environmental resource inventory. On a yearly basis does this budget funds trail clearing, park maintenance, and some related staffing costs,” details Freda. “So. our residents benefit from this fund literally every day.”

THE REST OF YOUR TAX MONEY

Beyond the municipal portion of your tax bill there are two other entities collecting taxes. As mentioned previously, the largest portion of your tax bill, 47%, goes to Princeton Public Schools. The budget is used to fund 4 elementary schools – Johnson Park, Littlebrook, Riverside and Community Park. It also funds Princeton Middle School and Princeton High School as well as providing money for Princeton Charter School, funding out-of-district placements and more.

In addition to a 2% Mercer County Open Space tax, the other entity you pay into, Mercer County’s $425.2million budget, is nearly $2m higher than last year. It helps to fund many things you may utilize such as Mercer County Park, Trenton-Mercer Airport and local roadways including Elm, River and Washington Roads.

If you have an eye for finances, you can take a closer look at the municipal budget here. Public hearings are held every spring, so if you are interested in understanding or weighing in on where your tax dollars go, keep an eye out for announcements usually in March for an April hearing date.

Lisa Jacknow spent years working in national and local news in and around New York City before moving to Princeton. Working as both a TV producer and news reporter, Lisa came to this area to focus on the local news of Mercer County at WZBN-TV. In recent years, she got immersed in the Princeton community by serving leadership roles at local schools in addition to volunteering for other local non-profits. In her free time, Lisa loves to spend time with her family, play tennis, sing and play the piano. A graduate of the S. I. Newhouse School of Public Communications at Syracuse University, Lisa was raised just north of Boston, Massachusetts but has lived in the tri-state area since college. She is excited to be Editor and head writer for Princeton Perspectives!