Every worker deserves a wage that keeps pace with the cost of living, a paycheck that reflects both their labor and their dignity. New Jersey took another step toward that promise on January 1, 2026, when the state’s minimum wage rose by $0.43, bringing the hourly wage floor for most workers to $15.92.

Every worker deserves a wage that keeps pace with the cost of living, a paycheck that reflects both their labor and their dignity. New Jersey took another step toward that promise on January 1, 2026, when the state’s minimum wage rose by $0.43, bringing the hourly wage floor for most workers to $15.92.

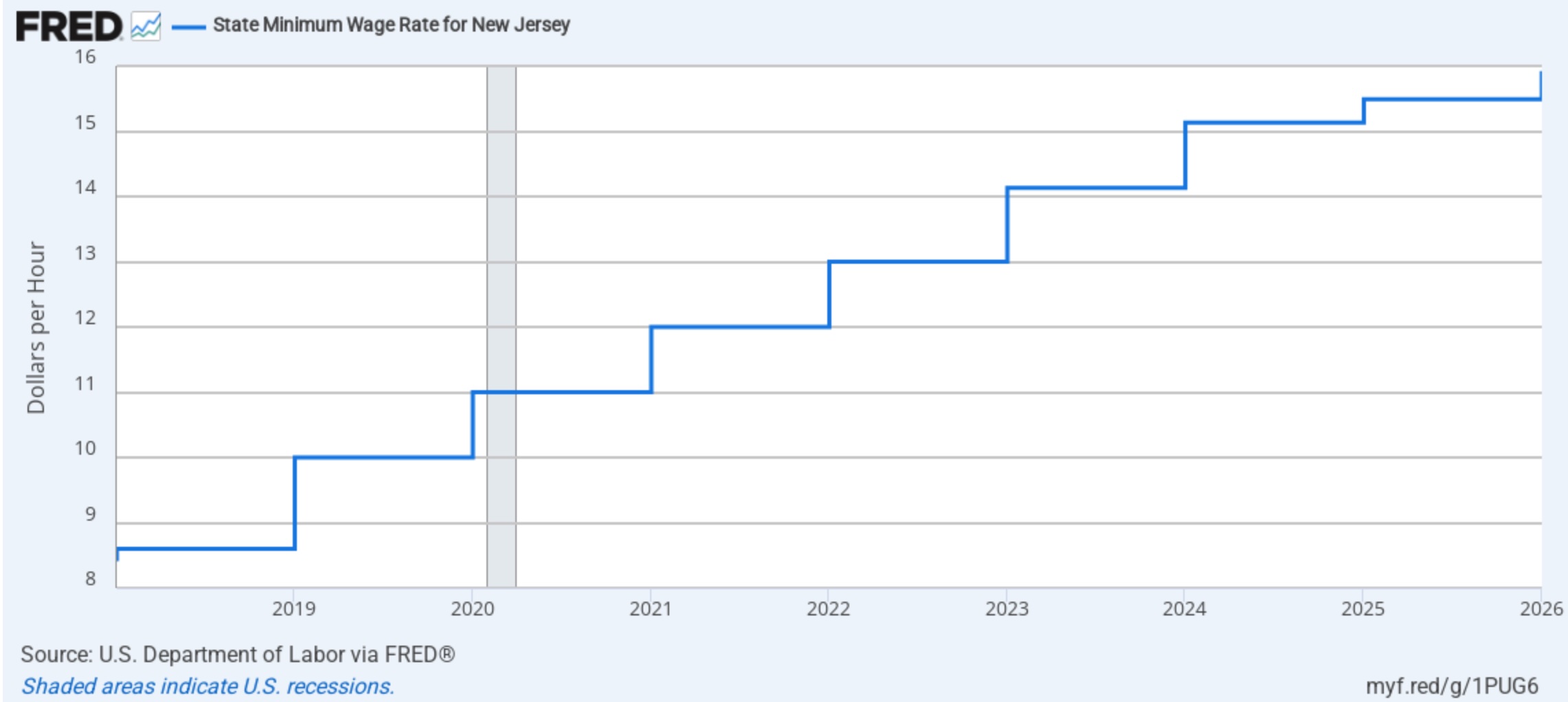

New Jersey reached this milestone through a deliberate, multi-year process. In 2018, Governor Phil Murphy and the State Legislature committed to structured changes to build a stronger and fairer economy by committing to steady wage increases. At the time, New Jersey’s minimum wage was $8.60 per hour. The first scheduled increase brought it to $10 per hour in 2019.

How Indexing Shields Workers from Inflation

Inflation quietly erodes the value of a paycheck. When the cost of groceries, rent, transportation, and other essentials rises faster than wages, workers lose purchasing power even if their hourly rate stays the same. Indexing protects against this erosion. Without automatic adjustments, the real value of the minimum wage declines year after year, leaving workers further behind despite working the same hours.

New Jersey’s approach recognizes this reality. What set the state apart from many others was not only the size of its minimum-wage increases, but also the structure behind them. Lawmakers tied future adjustments to the Consumer Price Index (CPI), a widely used measure that tracks changes in the cost of everyday goods and services. When prices rise, the CPI rises and, under New Jersey law, so does the wage floor.

For most workers, this reflects what they already feel in their monthly budgets. When the cost of living rises, paychecks don’t stretch as far. By linking the minimum wage to the CPI, New Jersey ensures that the wage floor keeps pace with real‑world expenses, protecting workers from losing ground year after year. These cost‑of‑living adjustments are essential to economic fairness and long‑term security. This policy choice is rooted in fairness, stability, and the principle that wages should reflect the cost of living, rather than fall behind it.

A Further Layer: Equity and Economic Justice

Raising the minimum wage is not only an economic policy choice but also a tool for addressing long‑standing inequities in who earns enough to live with stability and dignity. Low wages harm all workers, but they fall hardest on Black and other workers of color, especially women of color, who remain disproportionately concentrated in the lowest‑paid occupations far beyond their share of the workforce. These are the cashiers, home health aides, childcare workers, and fast‑food employees who keep New Jersey running yet continue to face some of the steepest barriers to economic security.

Raising the minimum wage is not only an economic policy choice but also a tool for addressing long‑standing inequities in who earns enough to live with stability and dignity. Low wages harm all workers, but they fall hardest on Black and other workers of color, especially women of color, who remain disproportionately concentrated in the lowest‑paid occupations far beyond their share of the workforce. These are the cashiers, home health aides, childcare workers, and fast‑food employees who keep New Jersey running yet continue to face some of the steepest barriers to economic security.

A stronger wage floor helps narrow these disparities. Research consistently shows that modest minimum wage increases do not lead to detectable job losses and that higher wage floors improve outcomes for families at the bottom of the income distribution. When wages rise, the benefits are felt most by workers who have historically been excluded from economic opportunity and by the communities that rely on their labor.

Embedding equity into wage policy is essential. It shifts the conversation away from a narrow tug‑of‑war between workers and small businesses and toward a broader recognition of the structural imbalances that have shaped the labor market for decades. Minimum wage increases are one of the most direct tools New Jersey has to counter those inequities and move toward a fairer economic exchange.

Who Benefits — and Who Still Gets Left Behind

Even with steady progress on raising the statewide minimum wage, not all workers benefit equally. New Jersey’s wage floor has strengthened economic security for hundreds of thousands of workers, but important gaps remain, especially for those employed in small businesses, seasonal jobs, agriculture, and tipped occupations. These exclusions mean that some of the very workers most vulnerable to low pay still earn less than the statewide standard, underscoring how much work remains to build a truly equitable wage system.

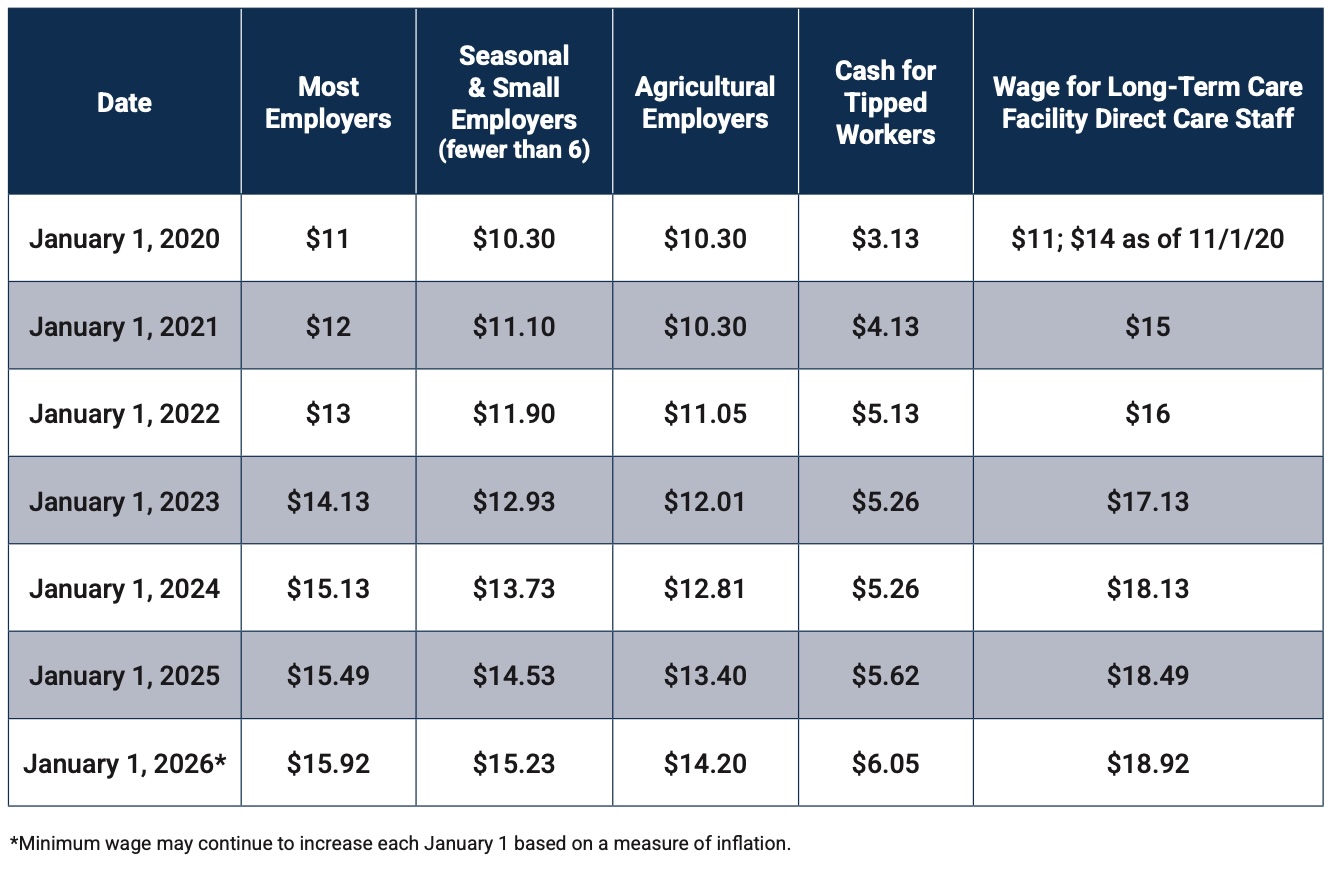

Many states allow exemptions for very small businesses or specific occupations, and New Jersey is no exception. Workers employed by businesses with fewer than six employees, as well as those in seasonal jobs, will see their minimum wage rise to $15.23 per hour — a meaningful increase, but still below the $15.92 received by most workers. Agricultural workers follow a separate timetable: farmworkers paid hourly or by piece rate will see their minimum wage increase from $13.40 to $14.20. Statutory increases for both small‑business and agricultural workers will continue on a phased schedule through 2028 and 2030, respectively, to lessen the financial burden on employers.

Many states allow exemptions for very small businesses or specific occupations, and New Jersey is no exception. Workers employed by businesses with fewer than six employees, as well as those in seasonal jobs, will see their minimum wage rise to $15.23 per hour — a meaningful increase, but still below the $15.92 received by most workers. Agricultural workers follow a separate timetable: farmworkers paid hourly or by piece rate will see their minimum wage increase from $13.40 to $14.20. Statutory increases for both small‑business and agricultural workers will continue on a phased schedule through 2028 and 2030, respectively, to lessen the financial burden on employers.

Long‑term care facility direct‑care staff will also see a $0.43 increase, bringing their minimum hourly wage to $18.92. This higher wage floor stems from a 2020 New Jersey law requiring that direct‑care workers be paid at least $3 above the statewide minimum wage, a policy designed to address chronic staffing shortages and high turnover in long‑term care settings.

Tipped workers will see their minimum cash wage rise from $5.62 to $6.05 per hour, while the maximum tip credit employers may claim remains $9.87. If a worker’s cash wage plus tips do not meet the state minimum wage, employers are required to make up the difference. Still, the reliance on tips means these workers remain among the most economically vulnerable.

Taken together, these categories illustrate a central tension. New Jersey has made significant strides in raising wages, yet some workers continue to be left behind. Highlighting these disparities is essential to understanding both the progress made and the policy choices still ahead.

Why Workers Can’t Afford to Lose Ground to Inflation

For many low‑wage workers, even a small increase makes a meaningful difference. A $0.43 adjustment may sound modest, but for a full‑time worker it adds up to nearly $900 more per year, income that can help cover a month of groceries, a utility bill, or part of a childcare payment. These gains matter in a state where too many families still struggle to meet basic needs. In New Jersey, about six percent of children live in deep poverty, and many of their parents work in low‑wage jobs where every additional dollar helps stabilize a household budget.

For many low‑wage workers, even a small increase makes a meaningful difference. A $0.43 adjustment may sound modest, but for a full‑time worker it adds up to nearly $900 more per year, income that can help cover a month of groceries, a utility bill, or part of a childcare payment. These gains matter in a state where too many families still struggle to meet basic needs. In New Jersey, about six percent of children live in deep poverty, and many of their parents work in low‑wage jobs where every additional dollar helps stabilize a household budget.

The more important comparison, however, is not between $0.43 and the full cost of living but between a world where the minimum wage continues to rise and one where it would have remained stagnant. Without annual cost‑of‑living adjustments, the real value of the minimum wage would erode each year, leaving workers further behind as prices climb. Instead, New Jersey’s indexing policy ensures that wages rise alongside inflation, preventing families from losing purchasing power and helping them keep up with rising costs. This is not to say that the current minimum wage is perfect. There is always room for improvement.

In Mercer County, the stakes are especially clear. A family of three (one adult and two children) needs roughly $11,874 per month, or $142,491 annually, to ensure a modest yet adequate standard of living, according to the Economic Policy Institute’s Family Budget Calculator. Meanwhile, a full‑time minimum‑wage worker in New Jersey will take home roughly $35,376 annually before taxes. The gap is large, but the annual increases to the minimum wage help prevent that gap from widening even further. For the thousands of Mercer County families living below or near the poverty line, these adjustments are not symbolic but essential to staying afloat.

New Jersey’s minimum wage increases have strengthened economic security for many workers, but they also highlight who still needs more support. Families living in or near poverty, parents working hourly jobs, and households facing high local costs all benefit when the wage floor rises and they stand to lose the most if it does not.

Stronger Pay, Stronger Local Economies

Small businesses do not simply absorb the effects of higher minimum wages; many benefit from them. When workers earn more, they spend more in their local communities, boosting demand for the goods and services that small businesses provide. Research from states that have raised their wage floors shows that higher wages can reduce absenteeism and turnover, lowering the costly cycle of recruiting and training new employees. Better pay also supports a more stable and productive workforce, which is especially important for small employers who rely on long‑term staff relationships to keep operations running smoothly.

New Jersey’s phased schedules for very small employers and agricultural operations were designed to give these businesses more time to adjust, but the broader economic effects point toward long‑term gains. As workers’ purchasing power increases, local economies strengthen, and small businesses are often among the first to feel the benefits. Continued monitoring is important, but the evidence from other states suggests that higher minimum wages can support both workers and the small businesses that anchor their communities.

Tax Changes Offer Little Relief Compared to Raising Wages

Recent tax changes from the One Big Beautiful Bill Act (OBBBA) have been framed as ways to boost workers’ take‑home pay, but for most low‑wage workers, their effect will be minimal. The federal “no tax on tips” provision, for example, is unlikely to meaningfully increase earnings for the majority of tipped workers, many of whom already earn too little to owe federal income taxes. Those with higher earnings may see slightly larger refunds, but the administrative burden of tracking and documenting eligible tips may limit how much workers ultimately claim.

A similar pattern applies to the new deduction for overtime premiums. While removing state tax on the overtime premium can help workers who rely on extra hours, the benefit applies only to the “extra half” in time‑and‑a‑half pay, not the full overtime wage. For many low‑wage workers, the resulting tax savings will be modest.

Taken together, these tax changes will not substantially alter workers’ financial stability or close the gap between wages and the cost of living. The most reliable way to raise incomes for low‑wage workers remains straightforward: raise the minimum wage. Policies such as expanding the Earned Income Tax Credit or moving the wage floor closer to a true living wage would do far more to put money in workers’ pockets than the limited tax adjustments included in OBBBA.

Conclusion

The minimum wage is more than a number on paper. It shapes the daily realities of hundreds of thousands of workers who keep New Jersey running. As New Jersey moves forward, the challenge is not simply to maintain the status quo, but to advance economic security for those most affected by low pay. Continued adjustments such as $0.43/hour, paired with thoughtful support for small businesses and complementary tax policies, can help build an economy where every worker has a fair chance at stability and opportunity.

The minimum wage is more than a number on paper. It shapes the daily realities of hundreds of thousands of workers who keep New Jersey running. As New Jersey moves forward, the challenge is not simply to maintain the status quo, but to advance economic security for those most affected by low pay. Continued adjustments such as $0.43/hour, paired with thoughtful support for small businesses and complementary tax policies, can help build an economy where every worker has a fair chance at stability and opportunity.

Tonanziht Aguas is a policy analyst for New Jersey Policy Perspective, focusing on economic security issues. Previously, she worked with the Center on Budget and Policy Priorities and with a Chicago-based family foundation. She is a graduate of the University of Chicago (MPP) and Rutgers-Newark (BA).